How We Support You

Get More from FiduciaryPlus™

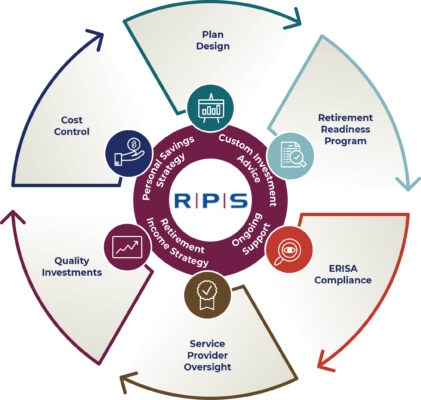

Your 401(k) plan should be a benefit that helps you attract and retain quality employees. As the plan sponsor and fiduciary, you have the task of providing this benefit in an efficient and effective manner for the company and your employees. As a 3(38) Advisor, our strategy for achieving this goal goes well beyond simply managing the investments. Our proprietary offering – FiduciaryPlus™ – focuses on six areas which combine into a holistic plan that closes the gaps that put your company and employees at unnecessary risk.

how it works