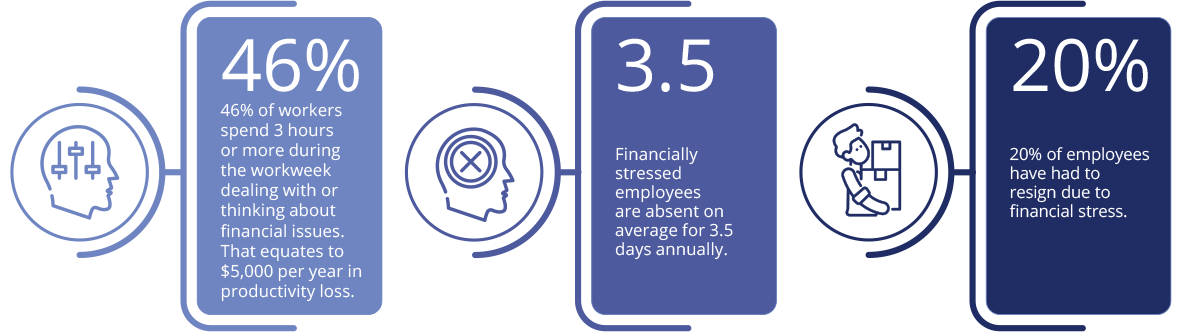

The Problem

RPS Financial Wellness is the Solution

RPS offers a comprehensive financial wellness and participant support program that has the power to give your employees the personalized experience they need plus access to trained financial professionals.

Our program’s advisors use their expertise, coupled with state-of-the-art financial wellness tools provided by our record keeper partners, to design short- and long-term strategies to guide your employees towards achieving Financial Wellness.

Decisions we help employees make:

- Cashflow & Budgeting

- Debt Management

- Rent vs Buy

- Asset Allocation

- Insurance Needs

- Retirement Planning

- Savings Strategies

- Situational Planning

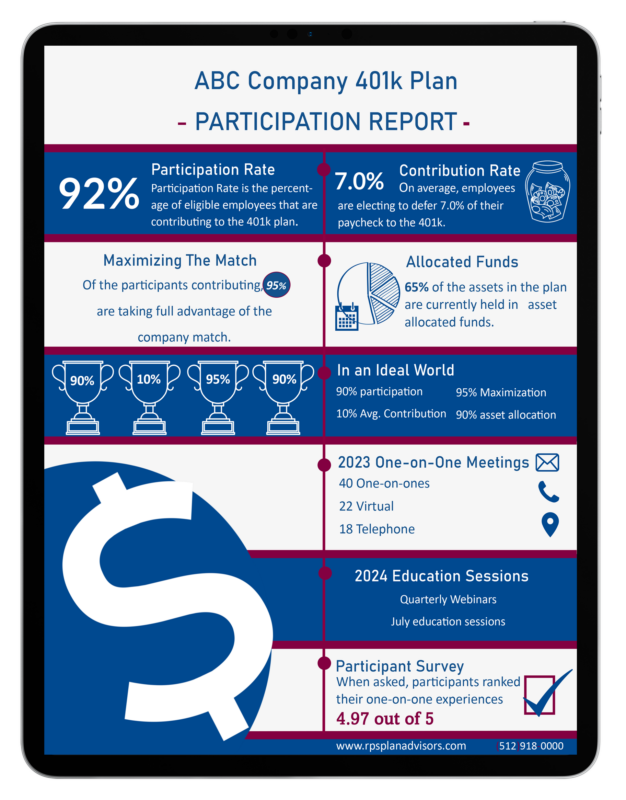

Plus, we provide high-touch, personalized interactions with your employees through:

- Group Education and Enrollment

- New-Hire Orientations

- Year-Round, One-on-One Meetings with Our Financial Planners

- Quarterly Financial Wellness Webinars (topics include debt management, investment basics, tax basics, and more)

- Dedicated Participant Portal with On-Demand Access to Our Educational Resources

“Financial stressors are not only negatively impacting employees, but are costing employers… These findings are concerning and potentially significant for companies looking to evaluate the return on investment of a financial wellness program.”

-Kent Allison, PwC Partner