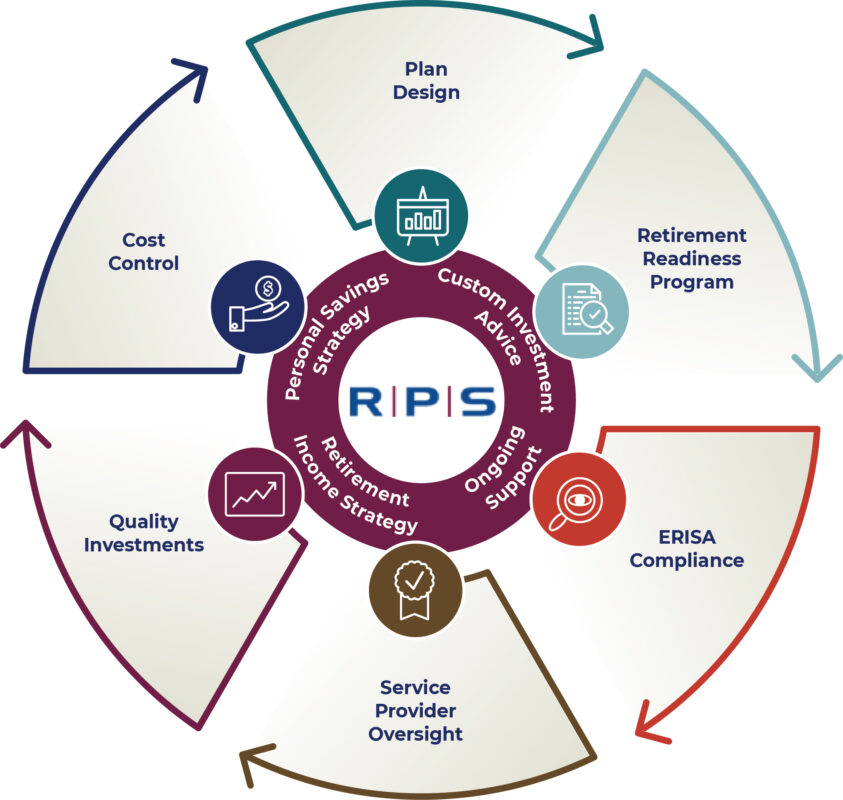

FiduciaryPlus from RPS provides a holistic 401(k) benefit plan that goes well beyond conventional investment advisory services. We look at six focus areas that are critical in creating a healthy plan that is highly valued by both employers and employees.

The resulting benefits include:

- A cost-effective plan

- Prized value to employees

- Reduced stress on sponsor’s workload

- Department of Labor audit readiness

- Limited company and personal fiduciary liability